Flood risk in Houston influences your home purchase through three key factors: flood-zone classification, insurance requirements, and a property’s specific drainage and elevation profile. Understanding these helps you evaluate risk, cost, and long-term value before you buy.

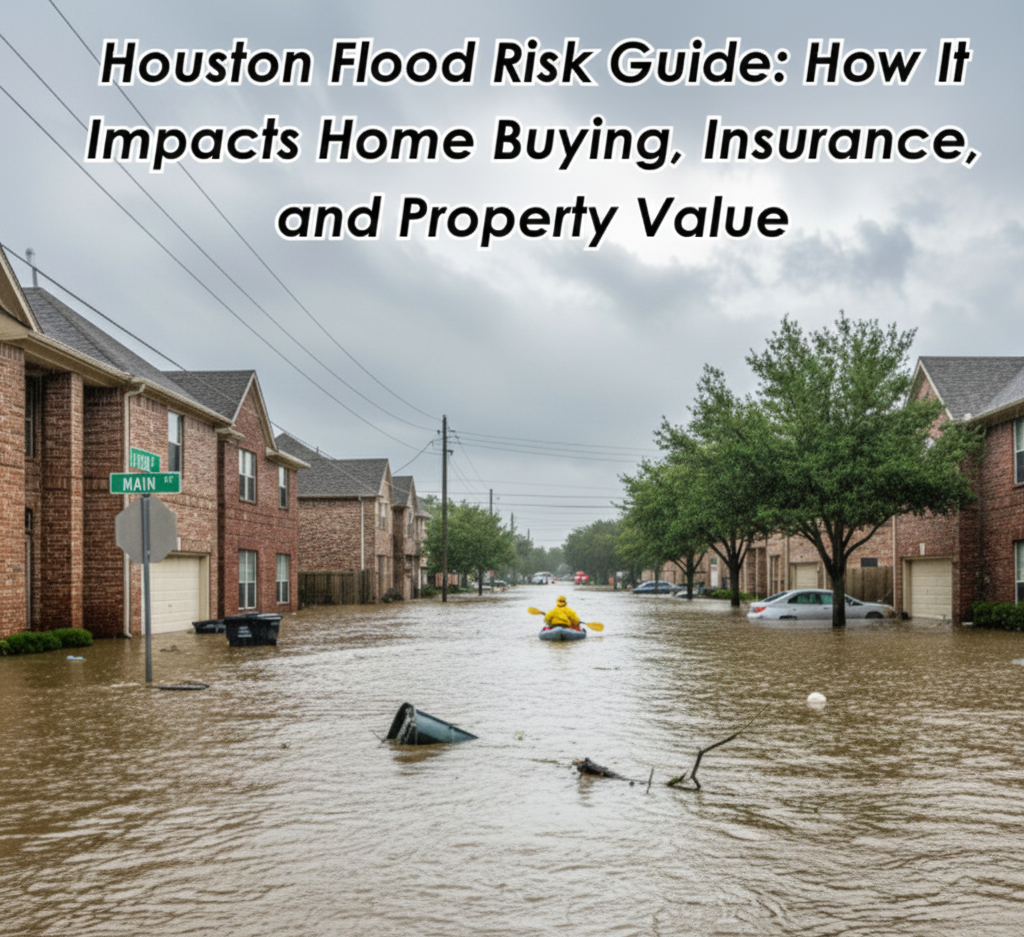

Houston Flood Risk Guide: How It Impacts Home Buying, Insurance, and Property Value

Quick Summary

Houston homebuyers must assess a property’s FEMA classification, confirm its Elevation Certificate, budget for flood insurance premiums (using Risk Rating 2.0 estimates), and verify compliance with post-Harvey building elevation rules. Local expert guidance is essential for navigating areas like Meyerland, The Heights, or Oak Forest.

At a Glance: How Flood Risk Impacts Your Purchase

- Changes your insurance costs and may trigger mandatory flood insurance.

- Affects which homes qualify for certain loans and lender requirements.

- Influences building and elevation standards that protect your home.

- Impacts long-term resale value and how future buyers view the property.

Understanding Houston’s Flood-Zone Landscape

When you’re buying a home in the Houston Metro Area, your first step should be checking the property’s flood-zone designation. FEMA’s Flood Map Service Center classifies areas with a 1% annual chance of flooding (the “100-year floodplain”) and lower-risk zones such as the “500-year” floodplain.

But Houston’s landscape is changing. FEMA and Harris County’s MAAPNext project are updating local flood maps to reflect more accurate rainfall, drainage, and urban-growth data. The new maps are expected to roll out in 2026, and many neighborhoods may shift classifications as a result.

Why this matters:

A property that appears outside a high-risk zone today may be re-designated once the new maps take effect. Working with a local expert who understands these pending changes can help you plan for both current and future exposure.

Flooding in Houston also doesn’t always follow predictable boundaries. Some high-risk zones have avoided major water events for years, while other “low-risk” neighborhoods have flooded multiple times. This is why local knowledge is key: a home in Meyerland or near a major bayou faces different risks than one in a higher-elevation area like The Heights or Oak Forest.

And during Hurricane Harvey, thousands of homes outside officially mapped flood zones still experienced flooding, a reminder that risk exists across the region, not only inside FEMA’s lines.

What this means for you:

- Use FEMA’s Flood Map Service Center to check a property’s official flood zone.

- Remember that “moderate risk” does not mean “no risk.” Just one inch of floodwater can cause over $25,000 in damage.

- Homes outside the 100-year floodplain, especially those built above the base-flood elevation (BFE), may offer stronger protection and lower insurance costs.

Building Requirements in Flood-Prone Areas

After Hurricane Harvey, the City of Houston strengthened its building standards for flood-prone areas. According to the City of Houston Floodplain Management Office, new homes or substantial improvements within the 500-year floodplain must now be constructed with the lowest habitable floor elevated at least two feet above the 500-year flood elevation.

In higher-risk floodway areas or for critical facilities, that requirement can increase to three feet above. These updates were designed to reduce flood losses, improve long-term resilience, and lower insurance costs for compliant properties.

What this means for buyers:

- Ask if the property was built (or remodeled) under the post-Harvey elevation rules.

- Verify whether the structure includes an Elevation Certificate.

- Understand that compliance with newer floodplain standards can make a meaningful difference in insurance rates and future resale value.

Flood Insurance Requirements and Costs

Once you identify a home’s flood zone, understand how it affects your insurance options and total cost of ownership.

Mandatory Coverage

If your home sits in a Special Flood Hazard Area (SFHA) and you have a federally regulated mortgage, flood insurance is required under the National Flood Insurance Program (NFIP).

Premium Factors

Insurance rates are now calculated under FEMA’s Risk Rating 2.0, which bases premiums on property-specific data such as elevation, distance to water, and flood history.

In Houston, premiums average between $500 and $2,000 per year, though some pay less or significantly more depending on risk mitigation and elevation.

What to ask as a buyer:

- Has the property had prior flood-insurance claims? (Note: Texas law requires sellers to disclose any known flood damage.)

- Is there an Elevation Certificate showing its height above the BFE?

- Can your agent estimate the future flood-insurance premium before closing?

Quick Tip: Want a personalized flood-zone analysis before you buy? Contact The Moore Real Estate Group (for a quick consultation; we’ll review your top listings and clarify each property’s true risk profile.

How Flood Risk Affects Home Value and Resale

Flood risk influences not just insurance but also market value and future resale potential.

Value Impact

- Homes in higher-risk areas often carry higher ownership costs and slower appreciation.

- Properties with flood-mitigation features such as elevated slabs or drainage upgrades can hold or grow value faster.

Resale Considerations

- Upcoming FEMA and MAAPNext map updates may shift boundaries. A property labeled “low risk” today could move into a higher-risk category later, potentially increasing insurance costs for future buyers.

Your Strategy

- Target homes with strong elevation and proven drainage.

- Budget for flood-insurance premiums as part of your affordability plan.

- Work with an agent who monitors Houston’s evolving flood-zone data and knows which neighborhoods manage water effectively.

Inside vs. Outside the 100-Year Floodplain in Houston

| Factor | Inside 100-Year Floodplain (SFHA) | Outside 100-Year Floodplain |

|

Likely insurance cost

|

Higher, often required by lenders | Lower, sometimes optional |

| Elevation requirements

|

Stricter elevation standards | Fewer or no added rules |

| Perceived buyer risk

|

More cautious, more questions | Generally more comfortable |

|

Resale considerations

|

Smaller buyer pool, more scrutiny | Broader buyer appeal |

Practical Tips for Houston Homebuyers

- Check FEMA maps early, don’t wait until under contract.

- Ask for Elevation Certificates and any flood-damage disclosures.

- Request multiple insurance quotes to compare coverage and deductibles.

- Stay informed about Harris County’s MAAPNext map rollout and possible re-zoning.

- Assess total cost of ownership, not just mortgage and taxes.

- Partner with a local expert; flood behavior in Houston can differ from one block to the next, and local knowledge is critical to understanding true risk.

Why Work With The Moore Real Estate Group?

At The Moore Real Estate Group, we specialize in helping buyers navigate Houston’s complex flood and drainage landscape. We:

- Analyze FEMA and Harris County Flood Control District maps for every property.

- Coordinate with flood-insurance professionals for clear cost projections.

- Identify neighborhoods that balance value and water resilience.

- Advocate for your best interests through negotiation and due diligence.

Want to see which neighborhoods balance value and water resilience best? Start your Houston home search with The Moore Real Estate Group; we’ll help you find listings that fit your needs and flood-risk comfort zone.

With the right preparation, flood risk becomes a manageable factor, not a surprise.

FAQs About Flood Risk and Buying in Houston

Is it safe to buy a house in a Houston floodplain?

It can be, if you understand the specific flood zone, elevation, drainage, and insurance cost, and if the home is built to modern standards with appropriate mitigation in place.

Do I need flood insurance if I’m not in a FEMA flood zone?

You may not be required to carry it by your lender, but many Houston buyers still choose coverage because localized heavy rain and drainage issues can cause flooding outside mapped zones.

Can a home that has flooded still be a good purchase?

Possibly, if the cause of flooding is understood, mitigation work was done correctly, the price reflects the history, and you are comfortable with future insurance and resale implications.

Key Takeaway

Buying a home in Houston means considering both opportunity and environment. By understanding flood zones, reviewing insurance implications, and leveraging expert guidance, you can make a confident, well-protected investment.

Call to Action

Ready to explore Houston homes with flood risk clearly evaluated from the start?

Call The Moore Real Estate Group today for expert guidance and a personalized flood-zone review before you buy.

Let’s ensure your next home is as secure as it is beautiful.

Disclaimer: We are not insurance agents. For questions about flood insurance coverage, premiums, or policy details, please consult a licensed insurance professional.